Competitive Intelligence that fuels your Marketing & Sales!

We will uncover your competitors' moves, marketing, and selling strategies so you can strategize better and win bigger.

About Your Initial CI Consultation

Are you feeling outmatched by the competition?

As your competitive intelligence partner, we will help you get an insider’s look at your competitors, analyze their strategies, and turn information into actionable intel so you can plan your future winning moves.

Let’s discuss your business goals and uncover hidden opportunities during a FREE consultation session. Also, we can provide a case study demonstrating the ROI of our competitive intelligence service.

Don’t delay! Schedule your free consultation today!

Book a FREE CI Consultation

Answer the questions below to personalize your 45 mins, non-binding consultation.

Here’s What You Get with our Competitive Intelligence Services

Competitor Intelligence can answer countless competitive questions and is of immense value if done correctly.

Competitor Intelligence (CI) is a powerful business tool that can uncover your opponents’ winning strategies and help you easily replicate and improve them to accelerate sales growth. CI can also strengthen your marketing and sales strategies by explaining your rivals’ systems, capabilities, and SWOTs.

Find below a couple of benefits of a competitive intelligence program for a company:

By analyzing your competitors’ marketing channels and details like traffic, backlinks, content, and newsletters, we can reverse engineer their winning strategies to replicate them later and improve them for your audience.

Understand the market and industry dynamics, including market trends, customer preferences, emerging technologies, and regulatory changes. This knowledge helps businesses stay ahead of the curve and identify new opportunities.

We setup an early warning system that monitors competitors’ activities and market developments. It enables businesses to anticipate changes, such as new product launches, pricing adjustments, or market entries, and respond proactively.

We find unexpected opportunities to reach your audience by researching others who already capture their attention. Also, we keep track of competitors, find new ones flying under the radar, and understand who reaches your audience most effectively.

Make informed and strategic decisions with access to relevant, reliable information and insides about your competitors. We will compare your website popularity, traffic sources, and engagement metrics to industry leaders by doing a competitive website analysis.

Organizations can identify potential threats and risks by monitoring the competitive landscape. This allows for proactive risk mitigation strategies, such as developing contingency plans, diversifying suppliers, or entering new markets.

Our Approach to Competitive Intelligence

While you focus on your business marketing and growth, our CI experts will scout your competitors’ digital operations and uncover their winning strategies using a proprietary CI framework that has proven to work for many digital businesses.

With over ten years of experience in digital business growth and six or more years in competitive intelligence, we have the expertise, tools, and experience to check competitors’ marketing channels to extract the correct information and reveal their winning strategies.

With this information, we will elaborate intelligence papers for you so you can make the right decision and make your next move.

1. Identifying Competitors

These preliminary stages may seem obvious, but they are necessary to see where to start our research and the relationship between you and these competitors. Also, we will find out more about your industry and its size.

2. Identifying Areas of Concern

We start our analysis plan by prioritizing your primary areas of concern. Of course, we can come across areas of concern that weren’t considered at this stage, adding these findings to our final report.

3. Gather Information

To find the newest updates and information, we investigate over 30 interest areas of CI, starting with the website, newsletters, social media, backlinks, trade shows, job sites, gov websites, industry reports, etc.

4. Elaborating intelligence

We now analyze the collected data to extract meaningful insights through various methods, including quantitative and qualitative research. We also look for patterns, trends, and relationships in the data to identify key findings and implications for your business.

5. Report Our Findings

This is the step where you finally get to see all of our work. We create a clear and concise competitive intelligence report that you can use to view all of our findings. Ensuring information is categorized well and easy to find is almost as important as the information itself.

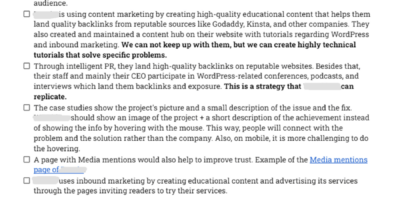

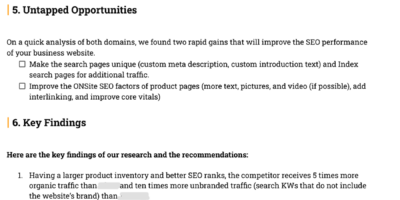

Real Examples of our Competitive Intelligence Reports

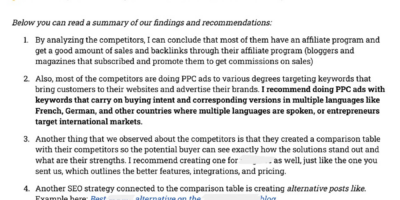

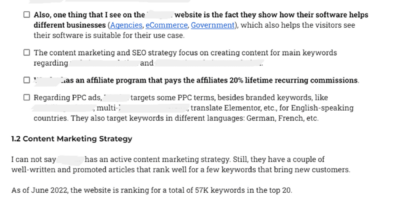

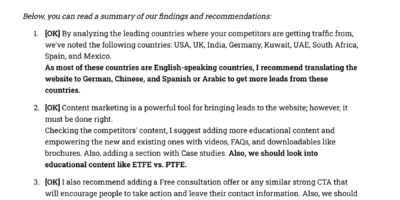

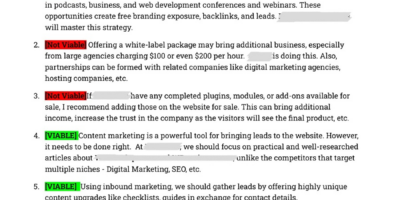

Below are screenshots of our conclusions and summaries of findings on a couple of our CI deliverables.

Our deliverables are 15-20 pages each, written by our CI specialist, and custom-tailored for your business. You will also receive all other support files, like reports and data interpretation.

We do not share here anything besides the summary of findings because this is sensitive intelligence for both the customers and us. Also, we stripped any customer identification details or other sensitive data before publishing.

Click on each deliverable picture to enlarge it.

Order a CI Report or a full Competitive Intelligence Program

While you focus on business growth, our competitive intelligence expert will identify your competitors’ moves that could give you a competitive advantage by executing winning marketing strategies.

We will uncover winning moves, marketing and selling strategies, traffic sources your competitors rely on, reveal popular keyword topics, benchmark website performance, and more to find ways to get the upper hand.

Competitive Intelligence Analysis for Digital Business

Our competitive website analysis will tell you how you compare to your competitors and how you can outperform them in marketing and sales strategy, traffic, keywords, backlinks, and more.

What’s included in the Digital Business Competitive Analysis:

- An in-depth check of 4-6 close competitors of yours (which we select together) conducted by a CI specialist in the following areas: Digital Marketing Strategy, Marketing channels, Missing opportunities, Keywords, Content, Backlinks, Traffic, SEO, Newsletters, Paid Advertising, and Social Media presence;

- A PDF analysis document of 10+ pages that covers all the findings and reveals winning moves you may implement in your business;

- 2-3 pages summary of findings that outline the current status of your digital business compared with the competitors;

- 1-2 page summary of your competitors’ winning activities and how you can replicate and improve them.

- All technical sheets and documents, crawls, exports, and data that support our CI report findings;

- A follow-up 1:30h-2h call on Zoom to discuss and explain all the results and your next steps;

- Get four weeks of support from our Competitive Intelligence expert (📧, 💻) after delivery;

- The CI analysis report will be delivered to you within three weeks of ordering;

- Suitable for digital businesses that want to increase their market share and outdo their competitors.

$1650/One-time

Competitive Intelligence Analysis + Ongoing Competitors Monitoring

We will always inform you about your main competitors so you can be better informed and implement winning strategies to stay ahead.

What’s included in the Digital Business CI Analysis + Ongoing CI Monitoring:

- Everything included in the Digital Business CI Analysis +

- Setup a CI program with objectives and KPIs to track your competitors’ moves;

- Monthly, we will gather updated data about your competitors: Digital Marketing Strategy, Marketing channels, Missing opportunities, Newsletters, SEO, News, and Social Media presence;

- Send you intell reports on trends & quick-Wins;

- Receive a monthly intelligence report about your competitors’ moves.

- Get explanatory documents for departments responsible for decisions or implementation;

- A monthly 1h-1:30h call on Zoom to deliver the report and answer questions;

- Get monthly support from our CI expert (📧, 💻);

- The option to work with us for the implementation of predictable ongoing SEO plans;

- We will set up the CI program within three weeks of ordering;

- There is a minimum commitment of six months to set up a CI program for your company.

- Suitable for digital businesses (SaaS, WP, Digital Product, and Service providers) with active competitors.

$1650/One-time + $850/monthly

Our digital business competitive analysis and the ongoing competitive intelligence program are designed to make it straightforward to work on the improvements in-house or have us care for some or all through our marketing strategy or ongoing SEO services. However you choose to proceed, you’ll be armed with what you need to make the right decision for your business and meet your marketing and goals.

Businesses we helped with Competitive Intelligence

Most of our clients for the competitive intelligence service are under NDA, so we can not make public their names, the industry they are active in, or a case study. However, here is a couple that we got their acceptance to make public.

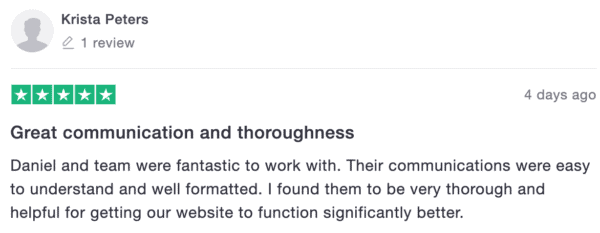

Testimonials

Frequently Asked Questions on Competitive Intelligence

What Is Competitive Intelligence?

Competitive Intelligence is the finding, sorting & critical analysis of information. To make sense of what’s happening and why. Find signals to predict what will happen & give options to control the outcome.

Who’s the team that’s running the Competico agency?

We are an international team of passionate digital marketing professionals who put together their digital marketing knowledge. Daniel, Competico’s CEO, has been doing digital marketing for over ten years, helping businesses grow, gain awareness, and extend their audience by amplifying valuable revenue-driven content.

What makes this agency special?

Well, several things set us apart from other service providers.

[1] Daniel and the team members are SEMrush, HubSpot, and Google certified. [2] Second, everything we do have been tested in the field for multiple customers, and [3] we are fully transparent and honest about our work. Read our blog to see exactly how we do things that bring results.

What is the minimum contract period?

The website’s competitive intelligence is a one-time purchase. We recommend getting one every one or two years, but it is not mandatory.

For the competitive intelligence program, there is a six-months minimum contract period. To see comprehensive results, we recommend committing for at least six months. So please make sure you choose the plan that matches your budget for the given period.

What are your payment terms?

After you agree with the estimate and the project roadmap, we request a one-month deposit to start working. The monthly payments must be remitted within ten business days of receiving the deliverables and invoice.

Still have questions. How I can contact you?

You may contact us through the project request form or email us at daniel{at}competico.com. We are passionate about our work and love to tell you more and answer your questions.

If you need more details, contact us at daniel{at}competico.com or by filling out the form on the Contact Us page. We will get back to you in a maximum of 2 business days.

Get in touch with Daniel Stanica, the Competico founder

We are eager to discuss new projects and ideas. Also, We want to show you how we leverage the power of our organic marketing and competitive intelligence services to help you grow your digital business.

About me

Just fill out the form so I can show you how, with my colleagues, we can accelerate your business growth and increase your market share.